The Fed is widely expected to slash interest rates at the conclusion of its latest two-day policy gathering, although the size of the possible drawdown and commentary around the move remain a source of debate.

Markets are all but certain the central bank will cut borrowing costs by at least 25 basis points from the current target range of 4.25% to 4.5%, while there is also a slim chance of a deeper, half-percentage point reduction.

Underpinning these estimates have been signs of a weakening U.S. labor market, which are seen overshadowing simultaneous indications of sticky inflation. In theory, a rate cut can help spur investment and hiring, albeit at the risk of driving up prices.

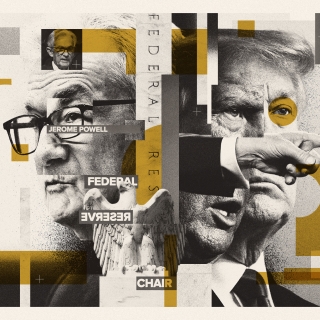

How the rate-setting Federal Open Market Committee, and, more specifically, Chair Jerome Powell, view the trajectory of the job market and inflation will be in sharp focus. Policymakers now face pressures to both sides of its dual mandate: maximizing employment while maintaining price stability.

Along with the more qualitative statements from the FOMC and Powell, the Fed will release an updated look at its members' rate projections for the months ahead a closely-monitored chart known as the "dot plot."

"Inflation remains above target and tariffs are likely to keep it elevated in the near term, but the balance of risks are tilted towards the need for more support for the economy," analysts at ING said in a note.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...